Singtel’s Specially Negotiated Deal for Suppliers — Invoice Financing at Preferential Pricing that Levels the Playing Field for Singtel and NCS suppliers

Finance your invoices with a loan that is exclusive for Singtel suppliers gives you up to $1 million gets approved in 24 hours Lets you pick the invoices you want to finance

- Access financing up to $1 million

- No collateral required

- Minimal documents

- Fast processing, funds in a day

- Tenor up to 5 months

- Limited time offer

Interested? Reach out to [email protected] or +65 82301958

-

Find out more about our other financing solutions: - Working Capital Loan

- Purchase Order Financing

Ready to get started?

Register now and your dedicated relationship manager will contact you

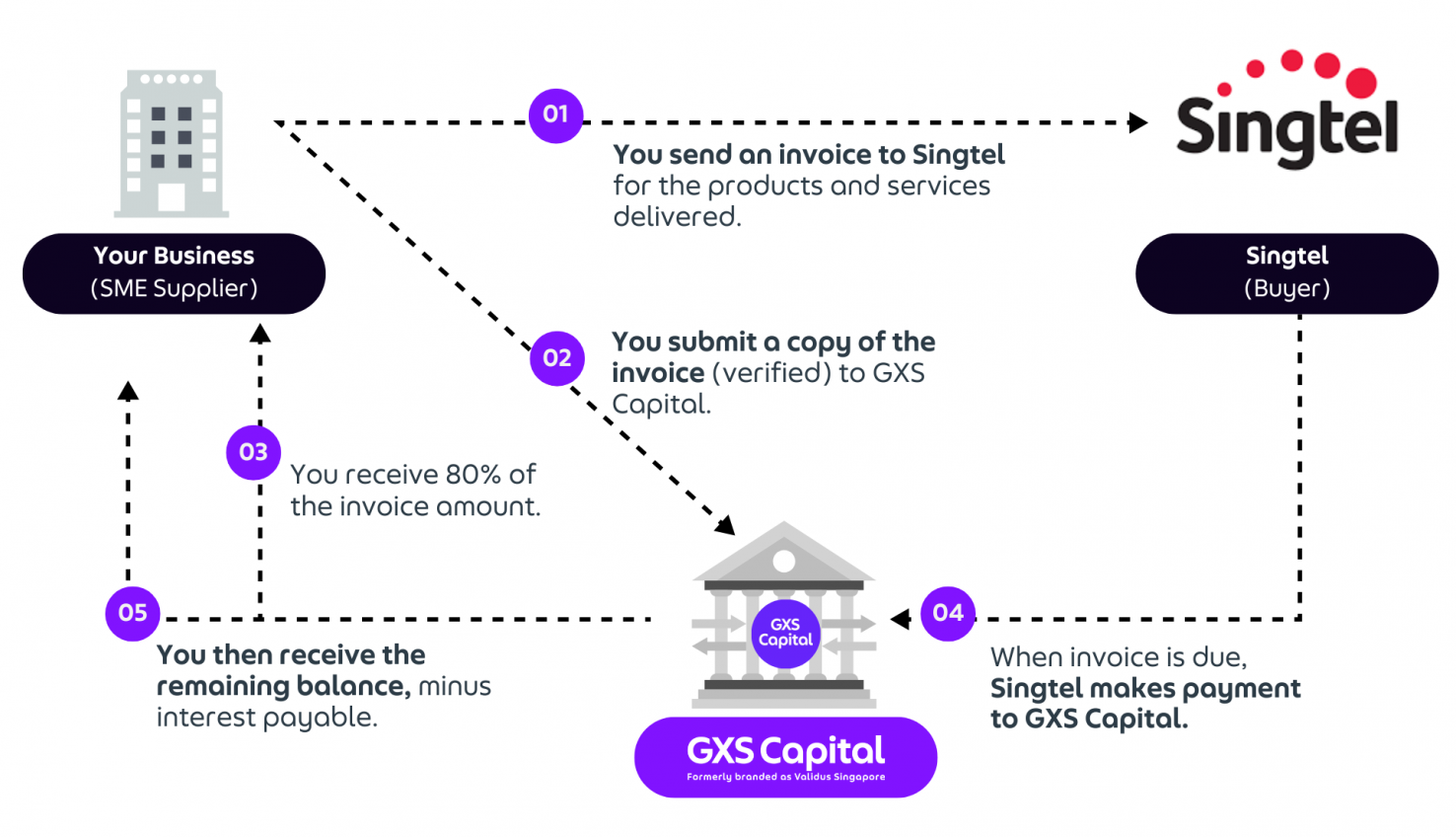

How does invoice financing work?

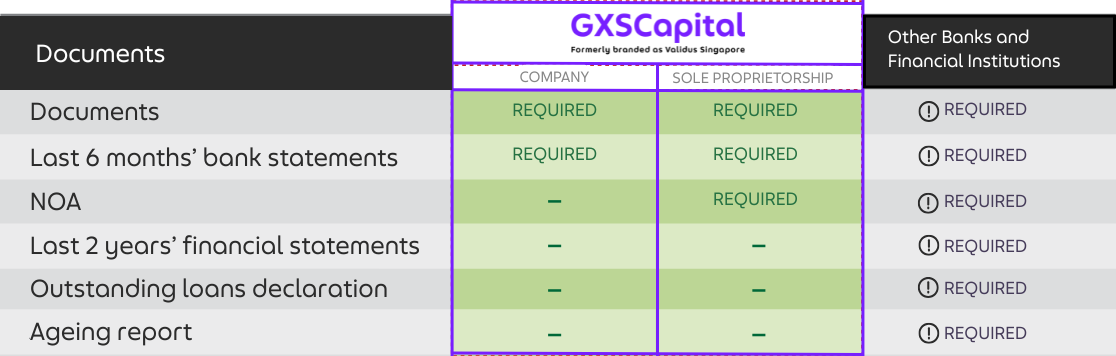

Why choose GXS Capital for invoice financing?

Fast loan approval outcome, as fast as 1 day

Preferential rates for Singtel vendors from as low as 0.25% per month

No collateral needed for loans up to $1 million

Pick and choose the invoices you want to finance

Why choose a working capital loan from Validus?

Compared to Banks and other Financial Institutions, we typically require less documents from you to get started.

Hear what SMEs are saying

We’ve disbursed over SGD 4.8 billion in business loans to SMEs. But don’t take our word for it…take theirs instead.

|

Introduction from [Placeholder], Group Chief Procurement Officer

Singtel has secured special rates from GXS Capital for financing against your approved Singtel and NCS invoices. This special pricing, available exclusively only to Singtel and NCS suppliers, levels the playing field by giving SMEs preferential rates usually reserved for large enterprises.

This limited time offer from GXS Capital allows you to get up to 80% of your approved invoice values typically within 24 hours, to support your cash flows in line with your needs, subject to eligibility and approval.

Frequently Asked Questions

We finance Singapore private limited companies that have been in operation for at least 6 months, and sole proprietorships (owned by Singaporeans or PRs) that have been in operation for at least 12 months.

The loan approval outcome will depend on the assessment of our credit and risk teams.

Important: The pricing of 0.25% per month with 0.1% disbursal fee is strictly applicable to Singtel suppliers only. Preferential rates are offered on a promotion basis and shall remain until further notice.

Simply get in touch with us with the form above. Once your application has been approved and the documents verified by our credit team, the funds will be disbursed to your nominated account within 24 hours.

- Submit your Singtel invoice to us after it’s issued.

- Secure up to 80% of the amount upfront once your application is approved.

- When Singtel pays us on the due date, we’ll send you the rest, minus interest.

- CBS of shareholders*

You could get up to S$1 million, a maximum of 80% of your invoice amount when you apply for invoice financing from GXS Capital. However, loan amount, interest rates and disbursement fee for any finance or loan request may vary and are subject to assessment by GXS Capital. Please reach out to our professionals to get a more accurate quote.

Loan Interest: 0.25% per month charged on the loan amount

Disbursement Fee: 0.1% per month charged on the loan amount

Late Fee: 1.5% of the outstanding loan amount

Borrowing from another financial institution or bank?

More of Our Products

Invoice Financing

Get up to $1 million in financing and receive early payments on your customer invoices

Purchase Order Financing

Get up to $1 million for project costs and supplies with your customer’s purchase order